Client login

Client login

- Blog

- Contact Client login

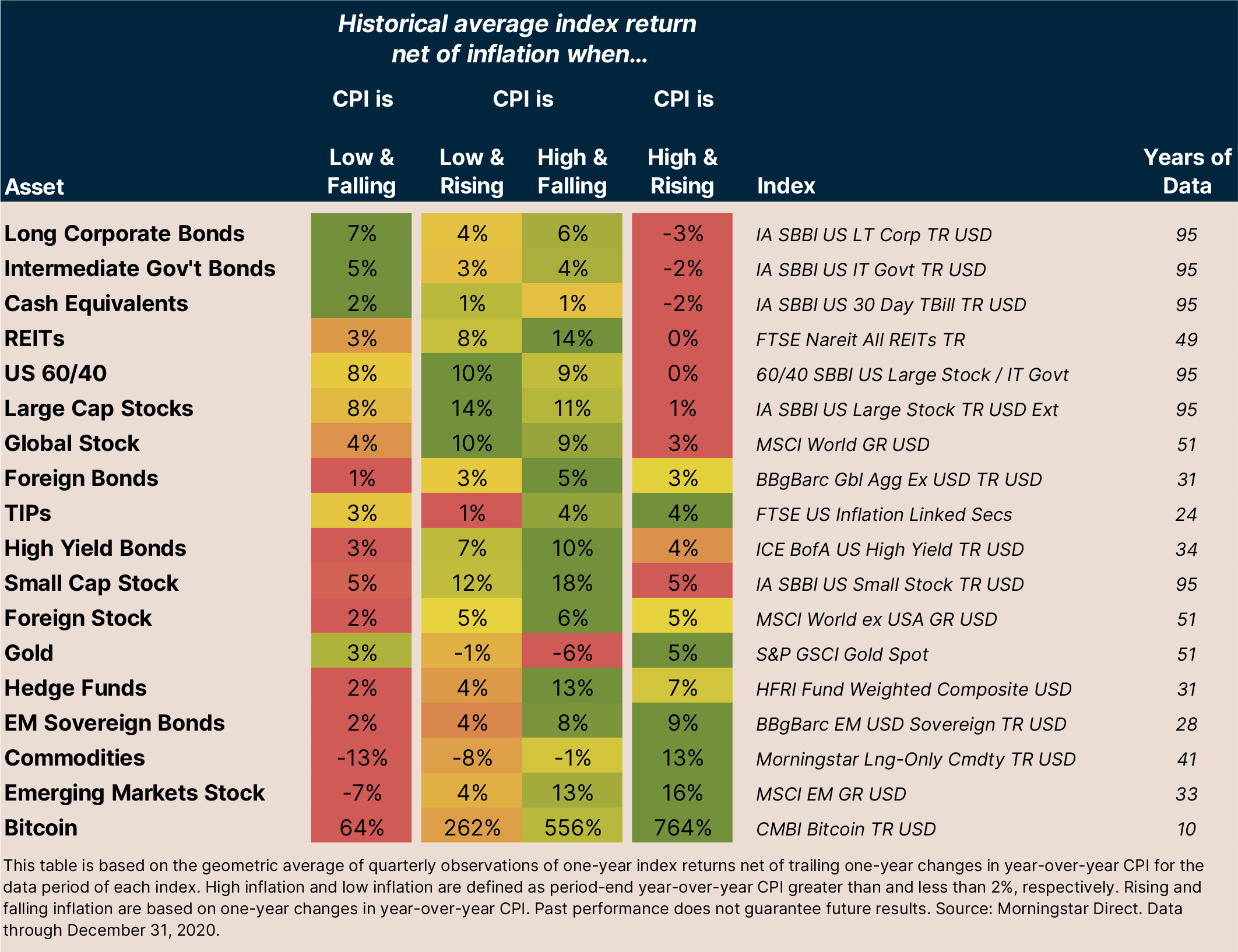

- U.S. fixed income investments have often performed best during periods when consumer prices were either low and falling or high and falling.

- Real assets and risk-sensitive investments have often performed well when inflation was either high and rising, or high and falling.

- U.S. investments have generally responded better to low and falling inflation than their non-U.S. counterparts.

- Non-U.S. investments have generally responded better to high and rising inflation than their domestic counterparts.

- Equities have often done well when inflation was normalizing (i.e., trending toward 2%).

- Gold has often done well when inflation was diverging from normal patterns (i.e., trending away from 2% inflation).

650 NE Holladay Street,

The Liberty Centre, Suite 1500

Portland, OR 97232

Understanding how investments respond to inflation

Do you remember the 1990s, when a cup of coffee cost less than a dollar? Or the early 2000s, when Apple stock traded for less than 50 cents? It seems that both consumer goods and investments have one thing in common — they tend to increase in value over the long term. (Although it’s possible for significant short-term declines in both consumer prices and investment values to happen, as we recently saw following the outbreak of the COVID-19 pandemic.)

If you are an investor who is looking to fund future spending from your investment portfolio, it is important to have realistic expectations regarding future inflation and investment return — not just as independent phenomena, but as a dynamic system where consumer price fluctuations can potentially affect investment returns, and vice versa.

This article explores the historical relationship between inflation and investment return by looking at how a variety of investment indexes have performed, net of inflation, during various environments between 1926 and 2020.

Based on the data summarized in the table below, we find that the net-of-inflation returns of investments have tended to respond to inflation as follows:

The following table, which is based on long-term averages, provides a more detailed illustration of these performance relationships across various types of investment. However, please note that this table is an archive of historical experience; it does not predict future inflation or investment returns.

As for future investment returns after inflation, it is important to remember that inflation is just one factor that can affect returns. Other factors, such as asset valuation levels, measured by indicators such as stock price-to-earnings ratio and bond yield, and fiscal and monetary policy, are also significant drivers of investment return. For example, given the current low yield environment and the Federal Reserve’s accommodative monetary policy, it is likely that future after-inflation returns for fixed income investments will be significantly lower than their historical averages, regardless of the inflation scenario.

We also think that the future performance of Bitcoin, a cryptocurrency launched in 2009, is likely to be lower than in the past as it matures and faces potential increased competition and regulatory oversight.

And as for a cup of coffee? Well, we have no special insight on how inflation might affect your favorite coffea arabica infusion, but if past average trends continue, a cup of coffee could set you back about $26 by the year 2100.