Client login

Client login

- Blog

- Contact Client login

650 NE Holladay Street,

The Liberty Centre, Suite 1500

Portland, OR 97232

How much is $10 million? Providing perspective for your children

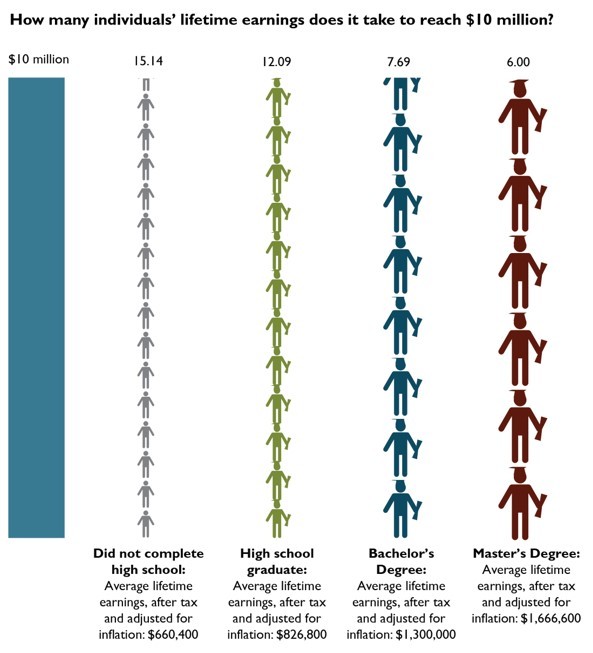

A client* recently asked me for advice on how to frame the size of a potential inheritance for an upcoming conversation with her son. Her son, who is in his mid-twenties, will be inheriting $10 million. My client sought a frame of reference to help him grasp how much money he’d be receiving and asked me how I’d put it in perspective. I was reminded of a calculation I saw back in 1996, shortly after I graduated from college, which gave me a perspective on wealth that I never forgot, so I’ve updated things by a few decades. Here goes:

According to the National Center for Education Statistics, the 2016 median annual income for young adults ages 25-34 who had a Bachelor’s degree and worked full-time was $50,000. If we assume that this group of young adults will receive cost-of-living increases of 3% per year, then the median lifetime earnings over a 40-year career will be $3,770,062. In other words, the median young adult entering the workforce today with a college degree will earn just under $3.8 million in salary over the course of his or her career. From this perspective, my client is leaving her son with the equivalent of the expected lifetime earnings of 2.63 college graduates.

The above math does not tell the whole story, however, because it does not factor in the loss of purchasing power over time – the dollar our hypothetical worker earns at age 65 will not buy as much as the one he or she earned at age 25. If we cancel out our 3% annual raise by a corresponding 3% increase in inflation, then today’s grad will actually receive $2,000,000 (in 2018 dollars) over the course of his or her 40-year career. From this perspective, my client’s son will be receiving the purchasing power equivalent of the expected lifetime earnings of five college graduates.

There is one more piece of the puzzle: taxes. In my client’s case, 100% of the assets flowing to the son are from a revocable trust, meaning the son will be receiving $10 million in after-tax dollars. Since our hypothetical young-adult worker has to pay taxes on his or her earnings, the math gets a little trickier: Assuming a combined 35% federal and state income tax rate, today’s grad should expect lifetime after-tax earnings of $1,300,000 (in 2018 dollars). From this final perspective, my client’s son will be receiving the purchasing power equivalent of the expected post-tax lifetime earnings of 7.69 college graduates.

Source: National Center for Education Statistics Fast Facts: https://nces.ed.gov/fastfacts/display.asp?id=77

For illustration purposes only

Wrapping our arms around large numbers can be a difficult task – especially when we are discussing emotional subjects like leaving assets to our children. Our team helps frame these conversations and provides the families we serve with the analytical (and emotional!) support to share this critical data with the next generation. In this case, our client felt that explaining the inheritance relative to the entire lifetime earnings of her son’s peer group was an informative perspective. If you’ve got questions about how to talk with your next generation about wealth transfer topics, we are happy to help out.

Source: National Center for Education Statistics Fast Facts: https://nces.ed.gov/fastfacts/display.asp?id=77

*Note: We have adjusted the details around our client’s specific situation to protect their identity.