Client login

Client login

- Blog

- Contact Client login

650 NE Holladay Street,

The Liberty Centre, Suite 1500

Portland, OR 97232

Why is Downside Protection so Important?

Behavioral economics tells us that people feel the pain of a loss more deeply than they feel the pleasure of a gain. For this reason, risk aversion is common among investors, as we try to avoid that pain. But there is a mathematical reason painful losses feel more impactful than gains; the return percentage needed to make up for a loss can be significantly greater than the loss itself.

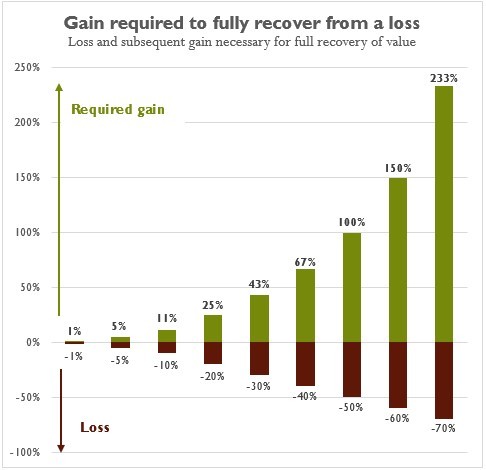

The chart below illustrates the percentage gain required to fully recover from a corresponding percentage loss, highlighting just why managing risk is so critical.

This chart illustrates why the concept of capital preservations is a key consideration in building investment portfolios. Risk in and of itself isn’t necessarily something to fear but it is critically important that it be managed in the context of the current opportunity set and taken advantage of or optimized during extreme points in a market cycle.

That’s why one of the tenets of Arnerich Massena’s investment philosophy is: “Capital preservation is essential.” Risk management is central to our investment process. To learn more about how we manage risk using uncorrelated assets and alternative investments, when appropriate, contact any of our investment advisors.