Client login

Client login

- Blog

- Contact Client login

650 NE Holladay Street,

The Liberty Centre, Suite 1500

Portland, OR 97232

79 Percent of Arnerich Massena Approved Equity Managers are Signatories of the United Nations-Supported Principles for Responsible Investment

When we began researching impact and sustainable investments over a decade ago, we didn’t set out to find impact investments. We set out to find great investments, and that objective led us to impact investments. Now, that premise is revalidated. Our focus on finding great managers has led us to managers who prioritize responsible investing.

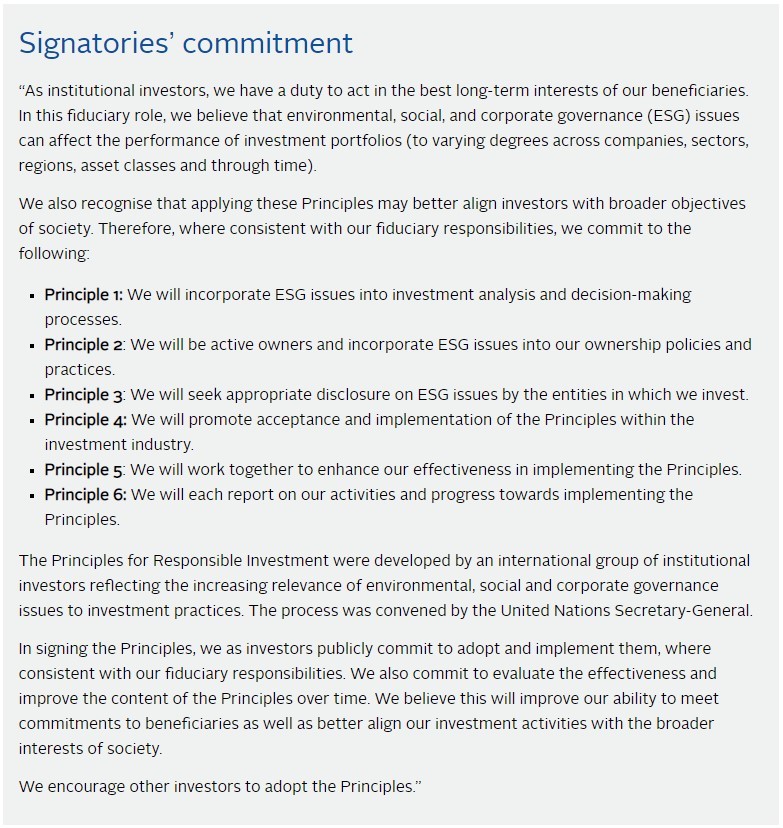

In 2019, Arnerich Massena became a signatory of the United Nations-supported Principles for Responsible Investment (UN PRI), as a public demonstration of the firm’s commitment to responsible investment. UN PRI is an independent, international body that acts as a global network for investors and policy makers who are committed to benefitting the environment and society through long-term responsible investment practices. Signatories commit to six fundamental principles that drive integration of ESG (environmental, social, and governance) and impact investing as a core aspect of their investment philosophies. As of June 2021, there were roughly 4,000 signatories across the globe, and the community is growing fast as the demand for responsible investment increases.

We are very pleased to report that nearly 80 percent (78.9 percent) of Arnerich Massena’s Approved Equity Managers are also UN PRI signatories. We do not require that Approved Managers be PRI signatories, but have begun including the question as part of our regular due diligence data collection. Discovering that such an overwhelming majority of our Approved Managers are PRI signatories is an indication of how well aligned they are with our outlook and philosophy, whether or not we identify them as being specifically impact-focused.

Our investment research over the last 15 years has led us to the understanding that investing responsibly and impact investing are not — and have never been — a form of philanthropy. ESG investing arose out of the recognition that sustainable business practices, fair and equitable governance, and innovative solutions to world problems are key drivers of growth and increasingly in great demand. Our research has suggested that these factors represent remarkable potential opportunity. This is another vivid illustration of the connection between responsible investment, opportunity to make an impact, and long-term return potential.