Client login

Client login

- Blog

- Contact Client login

650 NE Holladay Street,

The Liberty Centre, Suite 1500

Portland, OR 97232

A Sea Change in Volatility?

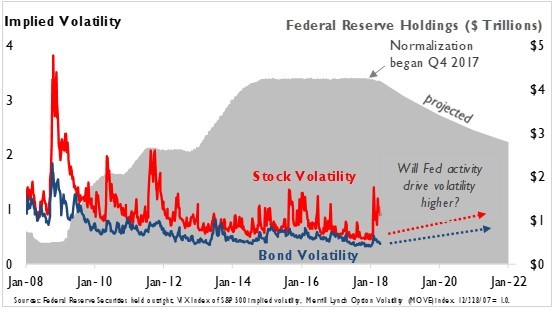

After hitting an all-time low in 2017, investor expectations of stock market volatility have started to rise this year. While these market jitters are at least partly due to eventful headlines, there’s another, more fundamental explanation that may be playing a role: The Federal Reserve’s decision to reduce its bond holdings may be contributing to increased volatility in the stock market.

In the chart below, the gray area represents the size of the Federal Reserve’s bond portfolio. Following the 2008 financial crisis, the Fed began buying trillions of dollars of bonds in an effort to restore market confidence and bring the economy back into equilibrium. Over the years that followed, the Fed’s quantitative easing provided increased bond market demand and liquidity, creating a beneficial “market tailwind” that successfully helped calm investors’ fears across most markets. We can see this in the gradual downward-sloping trend of the stock and bond option implied volatility indexes (red and blue lines).

However, last September, with the economy largely stabilized, the Fed announced that it was starting to reverse course and would begin to gradually shrink its bond holdings by not replacing securities as they matured. By reducing its role as a bond buyer and supplier of liquidity, the Fed is creating a “market headwind” that has the potential to move market volatility higher.

While future market volatility is subject to many inputs and virtually impossible to predict, we think it’s important to consider the incremental impact that the Fed’s recent policy reversal may have on market volatility over the next few years.

As an investor, what can you do to prepare?

After such a long period of market tranquility, you may want to revisit your portfolio and make sure that you are adequately diversified as a first line of defense. Having a long-term strategy designed to weather different types of markets seems less critical during calm periods, but its importance becomes very evident when volatility strikes. Consistent rebalancing helps make sure you are maintaining the long-term targets you set out for the portfolio. Using active management in your portfolio can serve as another shield against volatility; active managers are able to position themselves defensively and take prompt action when called for. Lastly, consider using hedged vehicles and/or private markets, both of which can provide additional diversification and risk management as well as return potential.