Client login

Client login

- Blog

- Contact Client login

650 NE Holladay Street,

The Liberty Centre, Suite 1500

Portland, OR 97232

Are you losing investment gains to taxes?

It’s said that death and taxes are the only certainties in life, but at least with taxes, there are ways to minimize the impact. For taxable accounts, taxes should be more than an afterthought; after all, they play a significant role in how quickly you reach your financial goals. Your realized investment return is not just your rate of return, but what you actually end up with after paying taxes on your gains. This is why tax-efficient investing is critical.

Investors who don’t have strategies in place for managing capital gains taxes may find that tax worries impact investment decision-making negatively; because realizing gains in a portfolio incurs taxes, investors may be hesitant to engage in trading, even when it could have long-term benefits to their portfolio. On the other hand, ill-planned investment choices could result in an outsized tax burden. Having a tax management strategy in place can prevent investors from passing up opportunities or being fearful of making important transitions because of taxes. Unfortunately, Cerulli Associates reports that as much as 70% of “tax-managed” assets are not systematically managed, and instead only employ tax strategies ad hoc.1

Tax-loss harvesting

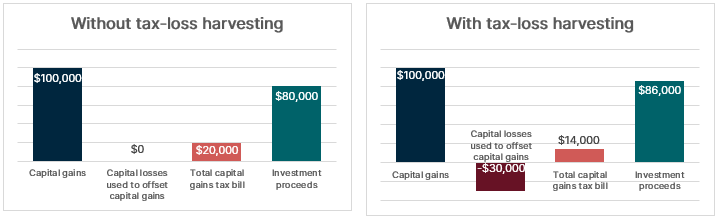

Tax-loss harvesting is one of the most impactful tax management strategies an investor can adopt; by using investment losses to offset gains, you reduce your overall capital gains tax bill. Tax-loss harvesting a portfolio over time is a challenge due to the need for manual tracking and recordkeeping, accounting for transaction costs, optimizing transaction timing, ensuring compliance with tax rules and regulations, and staying on top of asset allocation considerations.

Hypothetical example, for illustrative purposes only. Assumes 20% federal capital gains tax rate.

A solution: direct indexing

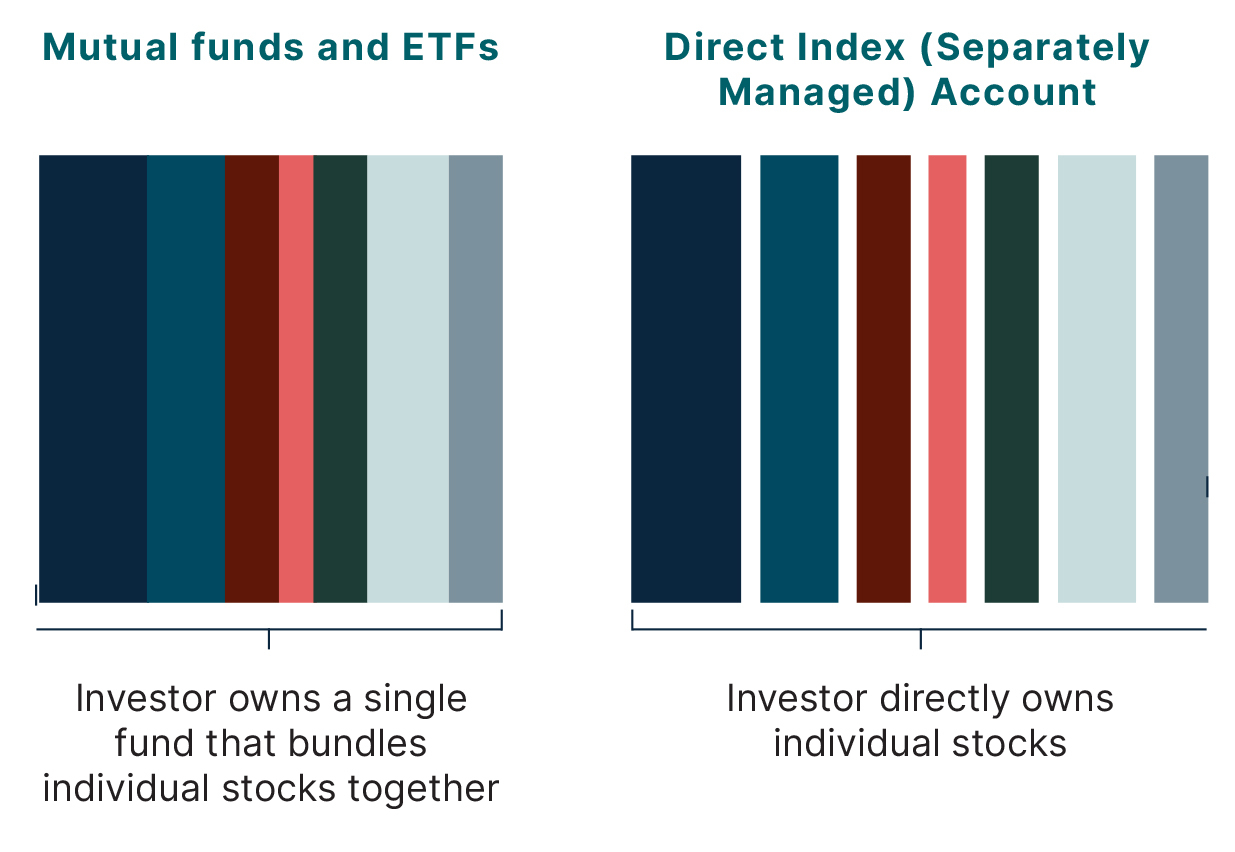

But now, improvements in technology have made it possible to achieve a tax-loss harvesting strategy that works efficiently and smoothly. Direct indexing ― also known as custom indexing or personalized indexing ― allows an investor to build a portfolio that replicates an index such as the S&P 500 Index, but that manages each underlying security as a separately managed account in order to provide individual control over each holding. The investment manager can then build in algorithmic trading to capture short-term tax losses that would be near impossible to manage manually. This can be executed throughout every trading day, generating a highly tax-efficient portfolio. With just a little up front work, the process can be largely automated and customized to an investor’s specific needs and preferences.

In addition to the tax efficiency, a direct indexing approach also provides far more flexibility in portfolio construction than a one-size-fits-all mutual fund or ETF. A custom index can avoid companies or sectors that don’t align with an investor’s values or objectives, or lean into any type of assets the investor chooses. For intentional and impact investors, this could allow them to divest from certain industries or seek out investment in desirable industries.

Direct indexing to mitigate portfolio changes

Being able to make adjustments to your investment portfolio is essential, as you rebalance, adjust your allocation to align with your changing time horizon and risk tolerance, and make tactical shifts in response to the investment environment. But sometimes it’s also important to have the ability to make larger changes in your portfolio. For example, consider the situation of an investor switching to a new advisory relationship ― as the investor transitions to new recommendations and trades out of legacy positions, it may lead to taxable gains. In this situation, a custom indexing portfolio can help to plan a gradual, tax-efficient transition to mitigate the capital gains.

Don’t let the threat of capital gains taxes prevent you from making investment moves that will benefit you in the long term. Tax considerations should not be the deciding factor in your investment strategy, and with tax-loss harvesting, they don’t have to be.

Learn more about direct indexing in a recent article from Senior Wealth Strategist Glen Goland, JD, CFP® here, or listen to our Ask the Expert podcast featuring Vanguard Direct Indexing Investment Manager Sherwood Yuen, here. One of the biggest decisions impacted by tax concerns is that of switching to a new investment advisor. This is why we offer our “second opinion” service, in which Arnerich Massena professionals will review your portfolio and provide a personalized assessment, including thoughts on tax efficiency; learn more about our second opinion offer here.

1Source: Cerulli Associates, The Case for Direct Indexing: Differentiation in a Competitive Marketplace, December 2022