Client login

Client login

- Blog

- Contact Client login

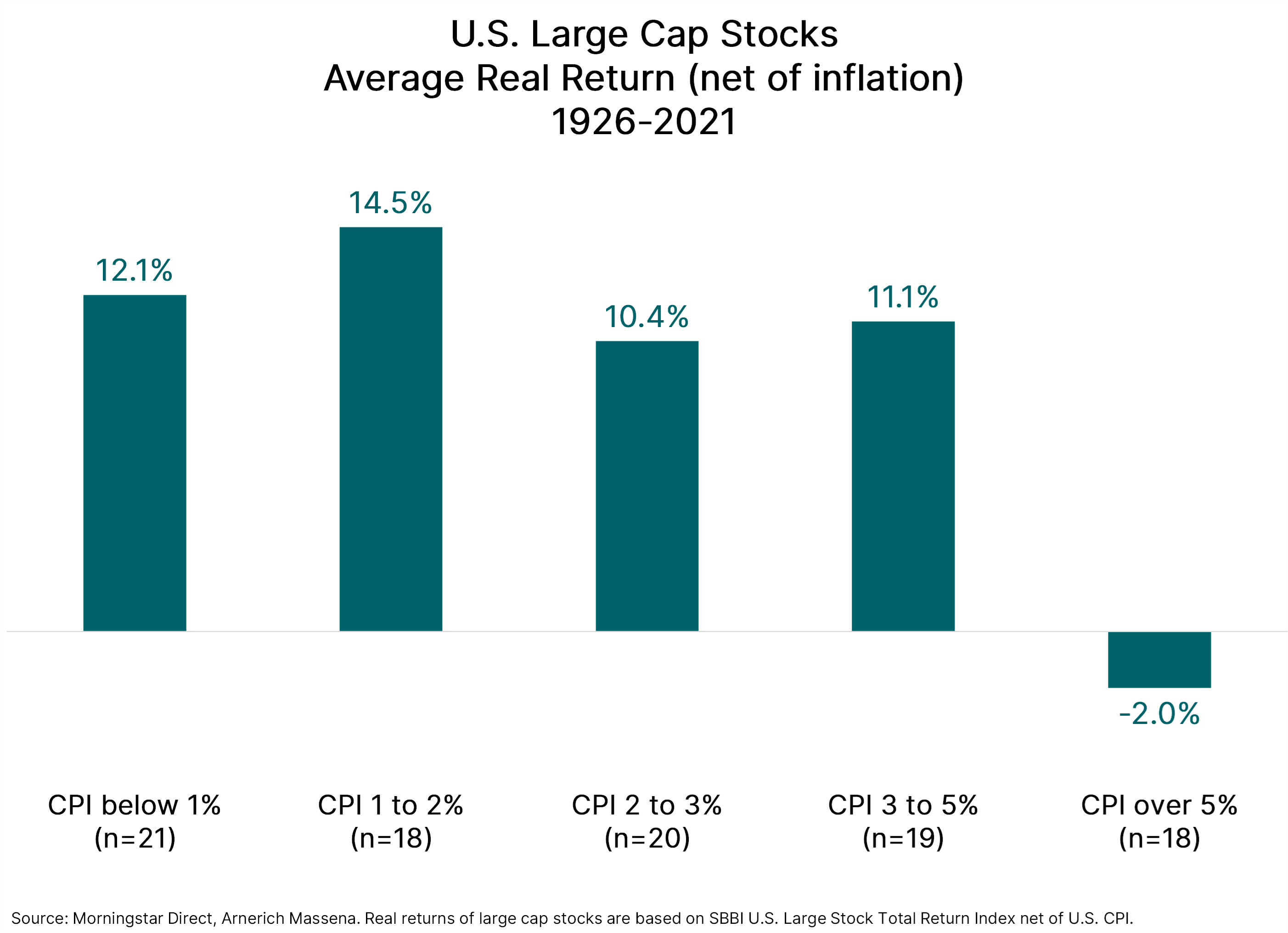

- U.S. large cap stocks tend to perform best (net of inflation) during years when inflation (as measured by Consumer Price Index, CPI) is below 5%.

- On the other hand, U.S. large cap stocks declined by an average of 2% (net of inflation) during years when CPI was over 5%.

650 NE Holladay Street,

The Liberty Centre, Suite 1500

Portland, OR 97232

As the Fed Battles Inflation, Will Stocks Suffer Collateral Damage?

Inflation hurts at the grocery store and gas pump, but what effect does it have on stock prices? Since it’s not uncommon for investors to allocate more than half of their investment portfolio in stocks, many investors are likely wondering what impacts to expect on stock returns from the current rising inflation, and from measures taken to help mitigate it.

U.S. inflation is definitely heating up; in 2021, consumer prices have risen 7.9% over the past year (as of 2/28/22), well above the Federal Reserve target of 2%. Even more worrisome is that in recent weeks, the war in Eastern Europe has contributed to a 27% year-to-date (through 3/9/22) rise in commodity prices, which could potentially drive future inflation even higher.

We expect the Federal Reserve to respond by raising interest rates this year. While this may help cool inflation, it may also detract from economic growth and create a headwind for stock prices.

Holding stocks has been a very successful strategy for investors in recent years; in 2021, the S&P 500 returned 28.7%. The big question is whether that will change now that inflationary pressure is intensifying. While we can’t see into the future, we can look to the past to provide some guidance. The chart below shows that over the 96 years since 1926:

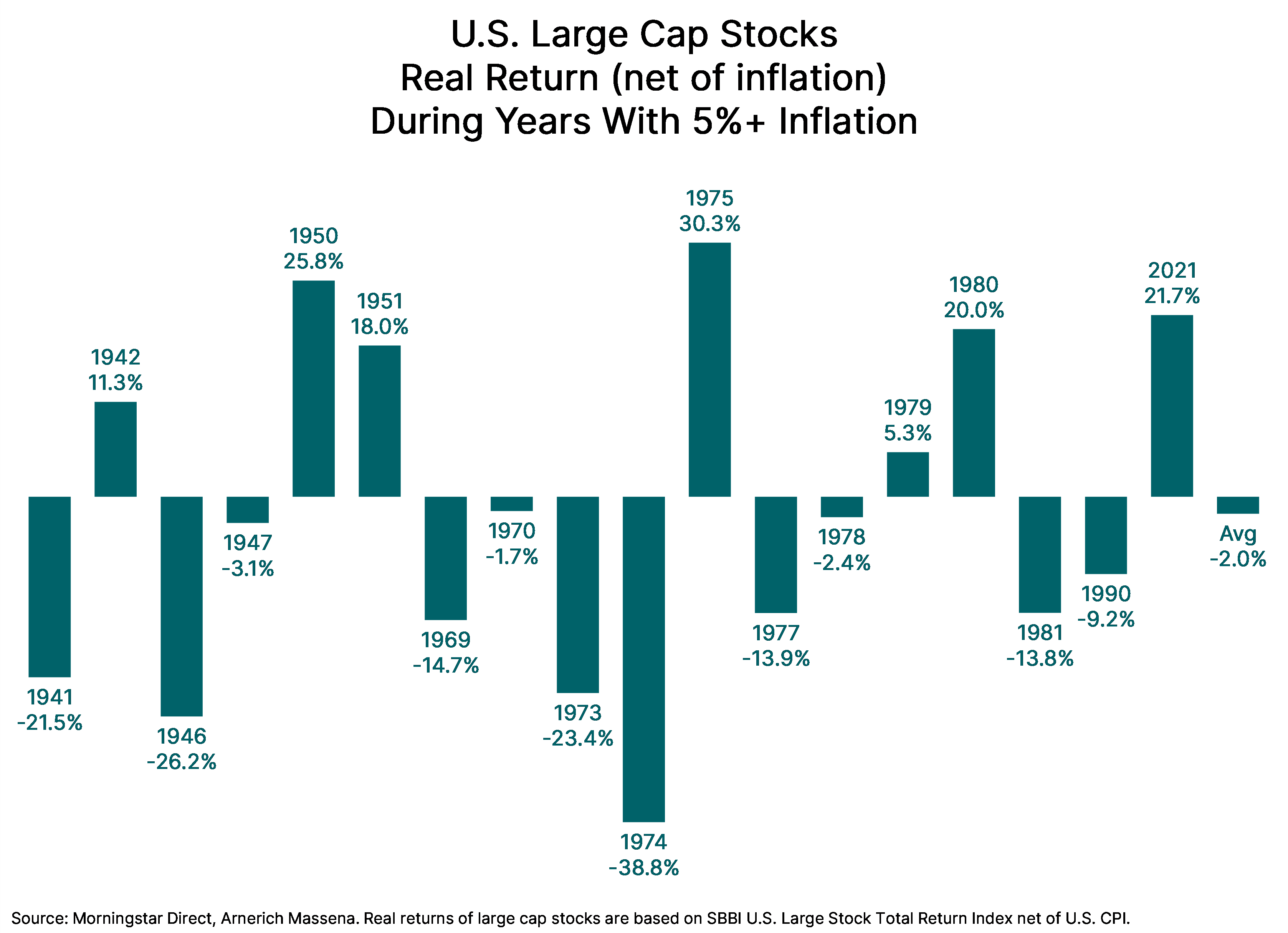

When we examine more closely those years when inflation rose above 5%, we see in the chart below that the 2021 net-of-inflation return of 21.7% was the third-best performance on record for this circumstance, making it a fortunate but atypical result. In 11 of the 18 years when inflation topped 5%, U.S. large cap stocks delivered negative returns (net of inflation).

What can we learn from this analysis? There’s no crystal ball that helps us see how stocks will perform in the future, but given that historical trends show that stocks tend to perform less well during periods of high inflation, it makes sense for investors to take steps to make sure their portfolios are well diversified and positioned to weather any market volatility. Holding investments that have a real asset component and hedging instruments can help provide an additional layer of protection during inflationary periods.

In addition to diversification, a long-term perspective can help investors see through periods of volatility to the bigger picture. Staying invested is the best way to capture the upswings that occur when markets regain stability. And stock investments may be one of the best instruments for earning a long-term return that can help you retain your purchasing power after a period of inflation.