Client login

Client login

- Blog

- Contact Client login

- Disruptive Technology

650 NE Holladay Street,

The Liberty Centre, Suite 1500

Portland, OR 97232

Disruptive Innovation: Investment trends to watch for in 2018

In 2018, we are facing the frontier of exciting changes, which could be called disruptive or innovative, depending on your perspective. In this time of synchronized global growth, when nearly every country is growing economically, what can investors expect in the New Year? Here we explore some trends we anticipate will be the focus of attention in 2018. Please note that we offer these predictions not as investment recommendations but as an interesting look into the cultural changes that may affect the investment environment for everyone.

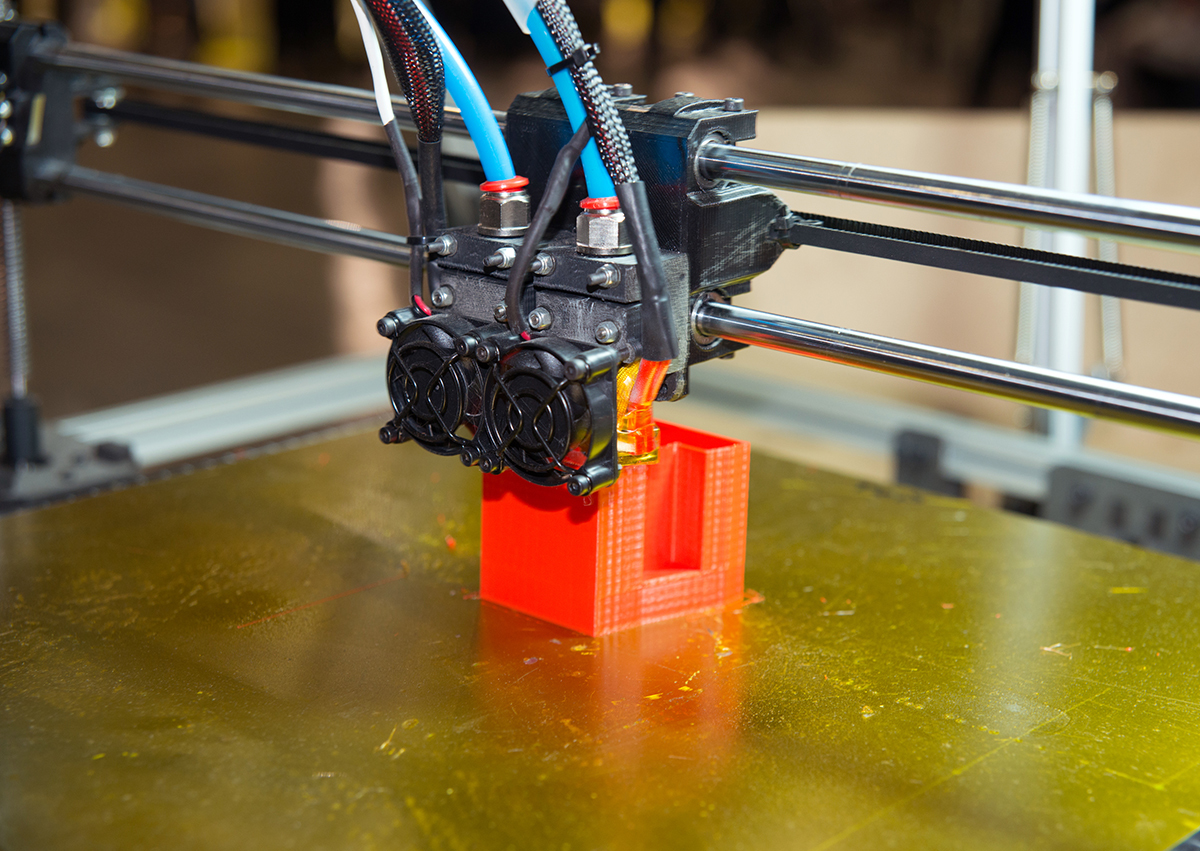

Imagine a world where nobody drives their own car or visits a grocery store, or where you print everything you need at home, from shoes to furniture. This world is closer than you may think, with the advent of new technologies like self-driving cars, drone delivery services, 3-D printing, and artificial intelligence. Industries like robotics, machine learning, and healthcare are positioned for radical advancement, while we’ll continue to see shopping malls close and car dealerships shrink. As we dive deeper into a world based on technology, data security will be a crucial topic in 2018.

One of the most disruptive technologies — with vast potential for multiple uses — is blockchain technology, which has given rise to cryptocurrencies. In addition to being an interesting foray for speculative investors, cryptocurrencies also represent another nail in the coffin for cash. Whether bitcoin or dollars, the digitization of money will continue in 2018.

2. Private Markets Go Mainstream

Today, there are half as many U.S.-listed public stocks as there were 20 years ago. The Wilshire 5000 Index no longer has 5,000 companies because there are not enough publicly traded companies! There is a consolidation at the upper end — where behemoths like Google, Amazon, and AT&T almost monopolize whole industries. At the smaller end of the spectrum, companies are waiting longer to go public, some until they can no longer even be classified as small cap stocks. Becoming or remaining a private company allows for greater flexibility to innovate and take risks. In this environment, investors are beginning to realize the importance of private equity alternative investments. With a possible return of public market volatility in 2018, we believe this trend will continue and investors will be looking to private markets to round out their portfolios.

3. The Sharing and On-Demand Economy

Uber is now the largest taxi company in the world, yet they don’t own any cars! Similarly, Airbnb is the largest hotel company in the world, yet it owns no property. Some of the disruptive (or creative) technology listed above is making possible a new kind of marketplace, called by some the “sharing economy” based on sharing cars, bicycles, and homes, or dubbed the “on-demand economy” because ownership is no longer necessary; one can simply order what one needs when one needs it. As it becomes easier to connect people and things, this trend will continue to expand, making possible both micro-businesses and the companies that organize these marketplaces.

4. The Rise of Millennials and Values-Based Investing

Millennials are taking over! Not really taking over, but the economic engine is beginning to look to millennials for the next few decades of growth, which means shifting to the values that millennials bring to the table. New millennial leadership roles in companies could change business models considerably. This is a generation that is used to having all knowledge at their fingertips, and are thus more connected with the process of how their products are made and how their services are delivered. They don’t just want good products and services; they are looking for their purchases to align with their values. Similarly, millennial investors will be seeking investments that support their principles and ideals. Look for the development of new ways to track an investment’s impact and positive influence on the world, which will become more important as the next generation moves into the economic driver’s seat.

5. Stepping out onto the Frontier

Often, an emerging markets rally is followed by a boom in frontier markets, as investors look a little further out for return. In addition to this boost, frontier markets have other winds behind them as well. As emerging markets further stabilize and become competitive technologically, much of the manufacturing work is moving to frontier markets. With large populations of working-age adults and significant room for economic development, frontier markets offer attractive demographics, cheap valuation, and fast growth potential.

Civilization is on the verge of major changes. Soon, we can look forward to life-lengthening healthcare technologies, 3-D printed homes, appliances that communicate with one another, and self-driving vehicles, to name a few. Not all of that will fully manifest in 2018, of course, but we are seeing the beginning of how some of these technologies will change the way we live our lives, and the way we invest our assets. As this revolution unfolds, we look forward to the opportunities the future is bringing and incorporating them into a thoughtful and disciplined investment strategy.