Client login

Client login

- Blog

- Contact Client login

650 NE Holladay Street,

The Liberty Centre, Suite 1500

Portland, OR 97232

Gasoline Prices and Stock Returns

With recent news of oil prices fluctuating on Ukraine tensions, the relationship between energy prices and stock returns is on many investors’ minds.

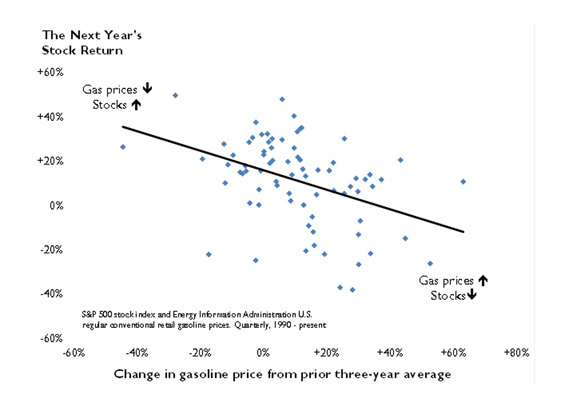

Looking at gasoline prices at the pump, we see a loose but potentially meaningful historical relationship between changes in gas prices and future one-year stock returns (based on the S&P 500 — see chart below). The downward slope of the trend-line indicates that large increases in gas prices from the prior three-year average have been associated (on average) with less attractive future stock market returns.

This is no surprise: higher fuel prices eat at consumers’ wallets and drive business costs higher.

Over the past year or two, the price of gasoline has remained relatively steady — a generally favorable situation for stocks. While there’s no telling what the future will bring to the stock market, gasoline prices might be a factor worth watching.