Client login

Client login

- Blog

- Contact Client login

650 NE Holladay Street,

The Liberty Centre, Suite 1500

Portland, OR 97232

The Dangerous Illusion of Recency Bias: What the past ten years won’t tell you

“The market is a pendulum that forever swings between unsustainable optimism (which makes stocks too expensive) and unjustified pessimism (which makes them too cheap). The Intelligent Investor is a realist who sells to optimists and buys from pessimists.”

~Jason Zweig, The Intelligent Investor

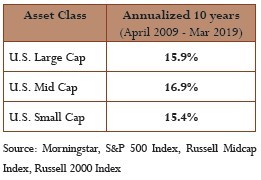

The first quarter of 2019 marks a full ten years since the March 9, 2009 bottom of the U.S. stock market during the financial crisis. This quarter, millions of investors opened their first quarter 2019 statements to be greeted by robust ten-year performance in their U.S. stocks:

While this performance is certainly worth celebrating, it may also be a bit deceptive. When considering these lofty returns, investors should keep in mind the very important fact that the last stock market bottom is now more than ten years ago. In other words, the extraordinary historical returns we are seeing are all from the post-crisis period and reflect only the “up leg” of the current market cycle, a very one-sided and recency-biased view of history.

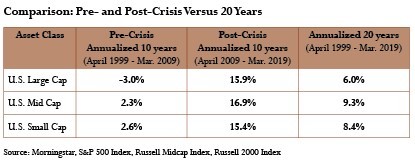

To get a more balanced perspective, compare these recent results to both the returns of the previous decade, and a longer view of 20 years (see the table below).

The fluctuations you see from decade to decade serve as a sharp reminder that long-term investing requires a broad historical perspective to take into account full market cycles — and that past performance does not predict future results.

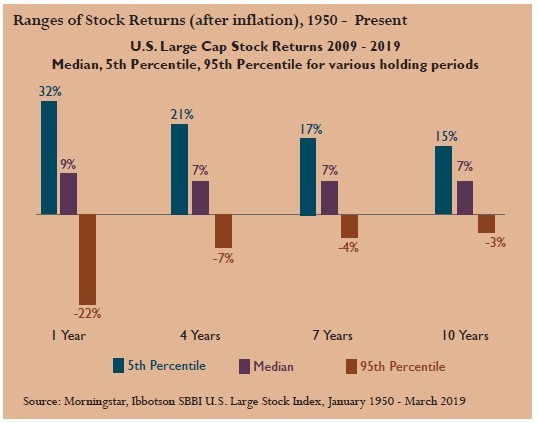

Looking at the broader historical perspective, it turns out that both of the last two decades have been highly unusual, measuring at approximately the 5th and 95th percentiles — or 1-in-20 events — when compared with all ten-year periods since 1950. The chart below, based on data from 1950 to the present, compares the median large cap stock market returns with the 5th and 95th percentile returns for holding periods ranging from one to ten years during that period, and demonstrates that these wild market gyrations have been unusual, though not entirely unprecedented.

However, when the returns of the two decades are combined, we see trailing 20-year returns that are fairly close to the very long-term averages, suggesting that together they may be more representative of a complete market cycle.

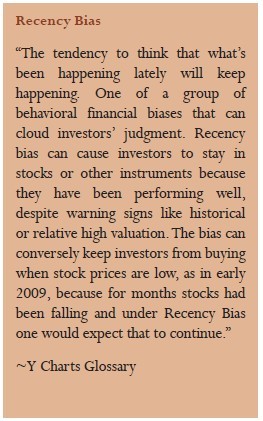

Recency bias is the tendency to focus on recent information that is easily available, while possibly excluding relevant information that may not be as readily accessible or visible. As the financial crisis rolls off of investors’ statements with the passage of the 10-year anniversary, it’s easy to leave it out of your thinking as you strategize for the future. We want to remind investors that a long-term approach requires a long-term perspective. Just looking at the last decade of returns is likely to set investors up for unrealistic expectations.

Our future expectations for stocks incorporate this long-term perspective and full market cycle review. We also avoid recency bias by building a dynamic, forward-looking approach, examining valuations and economic indicators that can drive future results. Most importantly, we never assume that history will repeat, so our portfolios are built to weather all sides of the market cycle.