Client login

Client login

- Blog

- Contact Client login

650 NE Holladay Street,

The Liberty Centre, Suite 1500

Portland, OR 97232

The Historical Relationship Between Presidential Party and Small Cap Stock Premiums

Investment researchers have long noted that historically, small company stocks have tended to outperform large company stocks over long time periods. And while this relationship has held true over extended timeframes, there have been many shorter-term periods where the opposite occurs. The most top-of-mind example occurred over the past few years, where we have seen some of the stock market’s biggest companies — such as Amazon, Apple, Microsoft, Facebook, and Google — deliver remarkably strong stock performance, outperforming their smaller counterparts by a wide margin.

This gives rise to the question: Are there systemic reasons behind the outperformance of the stocks of these mega-cap companies?

One working hypothesis is that systemic factors such as government policies toward international trade, corporate taxation, antitrust enforcement, consumer protection, labor law, and workplace and environmental safety could account for the recent tilt toward a large cap premium. This hypothesis further suggests that shifts in these government policies and regulations could affect the relationship between large and small cap stock performance. Better understanding this possibility can help us understand how the dominance of each political party could impact stock market outcomes.

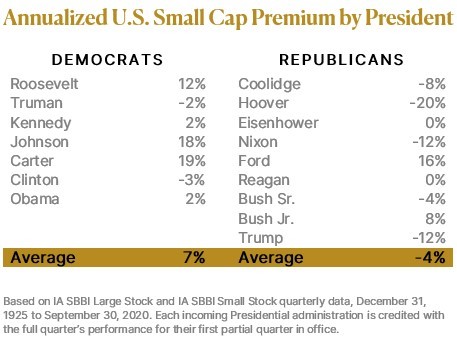

To test this hypothesis, we reviewed stock market performance from 1926 to the present, and found that historically, small companies have tended to outperform large companies during Democratic presidencies, while large companies have tended to outperform small companies during Republican presidencies. There were several exceptions, most notably the Gerald Ford and George W. Bush administrations. The table below illustrates the small cap premium over large cap stocks during each Presidential administration; you can see that the premium is on average positive (meaning small cap stocks outperformed large) during Democratic administrations, and on average negative (meaning large cap stocks outperformed small) during Republican administrations.

While it is impossible to predict the outcome of the 2020 election or the impact that the election might have on future investment performance, we do find it interesting and informative to look back and take note of this historical experience. As long-term, disciplined investors, we recommend pursuing a diversified approach with a long-term outlook. As we head into the coming election, we are reminded of the famous quote from Benjamin Graham: “In the short run, the market is a voting machine but in the long run, it is a weighing machine.”