Client login

Client login

- Blog

- Contact Client login

- Women tend to look longer-term, while men are more likely to track short-term fluctuations. It is estimated that men place 50% more market trades than women, as they tend to pay attention and be more reactive to short-term market moves.5 Women are more likely to build a long-term strategy and then stick with it in spite of volatility.

- Men seek out more risk, whereas women have a lower tolerance for risk. Surveys suggest that men look at investing as a challenge in which outperforming the market represents success. They are more likely to be aggressive and take risks in an effort to achieve that feat. Women, on the other hand, tend to see investing more as a means to an end. They are more likely to be risk-averse, approaching their long-term objectives with caution.

- Women do more research. This may be due to a greater degree of caution or to a lesser degree of confidence, but studies have shown that women spend more time researching investment options.6

- Women and men have different investment values. Men tend to be competitive, seeking to outperform or win. Women’s goals lean more toward alignment – with values, others, or just long-term goals.

- Men talk more than women. The stereotype is the reverse, but the truth is that men tend to dominate conversations more than women.

- Women tend to be more interactive speakers, looking for feedback cues. They are generally more comfortable with a back-and-forth dialogue, whereas men often prefer to speak uninterrupted, presentation-style.

- Men are more concise than women. Men appreciate being short and to the point, while women may be more inclined to explore the details of a topic or chat about extraneous subjects.

650 NE Holladay Street,

The Liberty Centre, Suite 1500

Portland, OR 97232

Women in Investing: Why we need gender balance on advisory teams

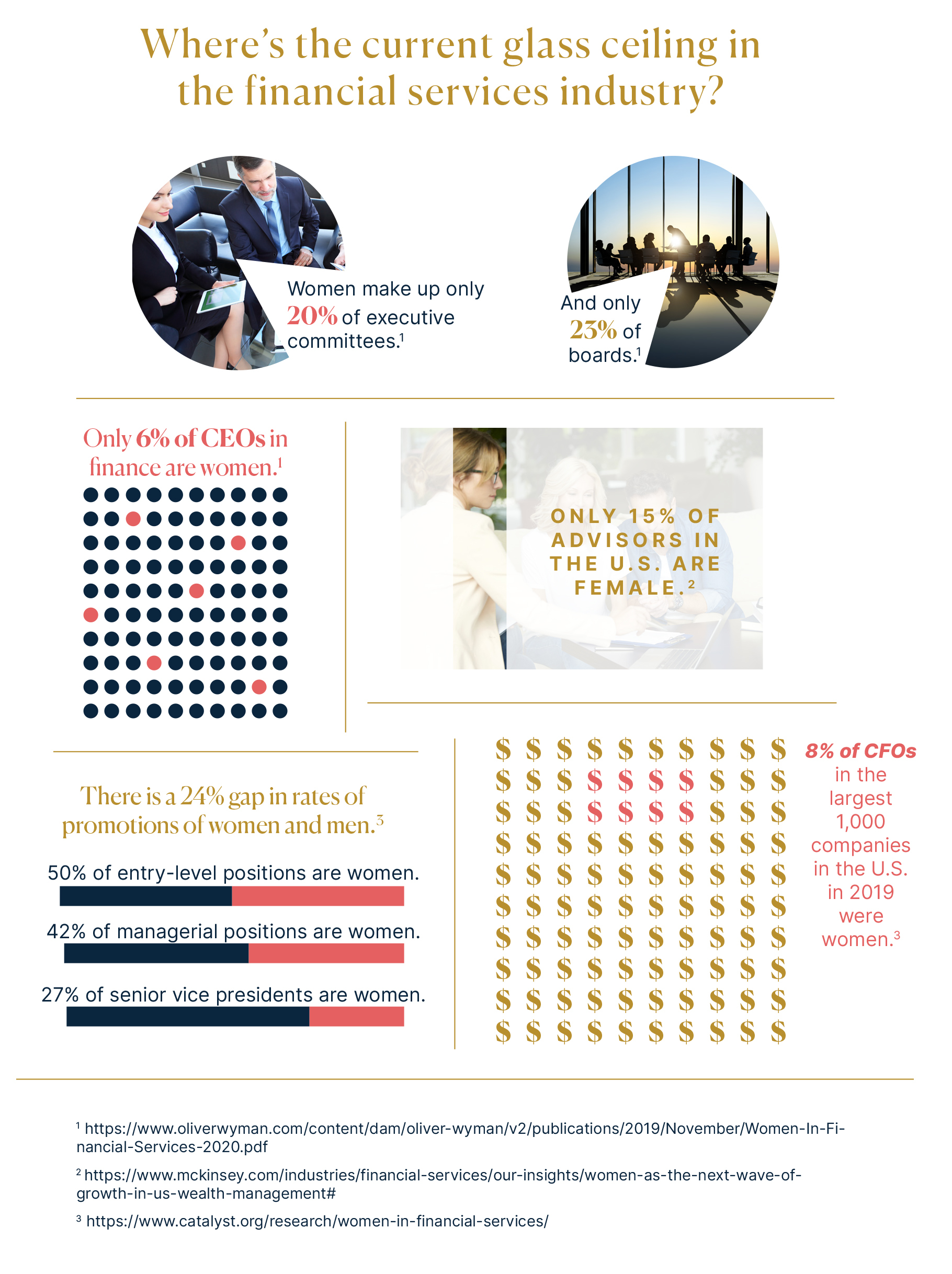

This month is Women’s History Month, and while we celebrate the impact women leaders have had on our history, we are also reminded of the challenges women still face to earn equal recognition and status. The good news? In many areas of business, the landscape is improving; for instance, the number of female entrepreneurs has increased by 114 percent over the past two decades1, women now represent more than 50 percent of medical scientists2, and more than a third of global (MSCI ACWI) company boards included at least three women by 2019.3 A widely circulated McKinsey study showing that companies in the top quartile for gender diversity were 21 percent more likely to experience above-average profitability than those in the bottom quartile may be helping to move the needle for gender balance in business.4 But some industries, such as STEM fields and financial services, continue to lag behind. See the infographic below to learn where some of the gaps lie.

A failure to bring diversity to our teams ultimately fails those whom we are meant to serve. Financial services clients benefit from working with teams that include a balance of genders and diversity of backgrounds. Gender balance is an important factor in client service and portfolio management, and can meaningfully impact long-term outcomes. Women invest differently than men; women and men offer different styles and strengths when it comes to communication; and men and women bring different experiences to bear that can foster understanding of clients’ unique objectives, challenges, and concerns. In honor of Women’s History Month, we wanted to examine some of the key reasons we think it’s critical to have both women and men as part of your advisory team.

Women invest differently than men.

While there is plenty of individual variation, multiple studies have demonstrated that in general, women’s investment approaches tend to differ from men’s in several notable ways.

While many of these studies base their findings on individual investors (as opposed to advisors), the results still suggest some trademark characteristics that influence how the genders may operate differently when it comes to portfolio management. There is no way to compare the two styles and determine whether one or the other is a conclusive winner or outperformer, as they are both valuable to the investment process. We believe that the optimal approach is a combination of the two, bringing together confidence and aggressive curiosity with cautious research and measured discipline. Having a balance of voices participating in the process is, we believe, accretive to long-term portfolio outcomes. And having men and women together on a team means they can learn from each other, taking advantage of one another’s strengths and counteracting weaknesses.

Men and women communicate differently.

Everyone has their own singular way of relating to others, and personality differences account for many individual communication preferences, but studies show that men and women demonstrate significant differences overall in how they communicate. Whether the dissimilarities are inherent or socialized is its own argument, but they are relatively consistent in our culture. Here are just a few of the notable contrasts:

What this boils down to is not that there is a better or right way to communicate and interact, but that a team with both men and women is more likely to have a broader range, making it possible for clients to feel comfortable and resonate no matter where they fall in their own communication styles.

The benefits of advisory team balance

Over the next three to five years, an estimated $30 trillion in assets will pass into the hands of women in America, about a three-fold increase from today’s balance of wealth. This will accompany a shift of wealth from baby boomers to a younger generation as well. This new group of wealth holders has different values and objectives, and will be faced with a new set of concerns and issues; having an advisory team that can understand them and is able to build a strong rapport will be better positioned to provide the kind of service they will want — and need. And the more diversity a team of financial professionals can offer, the more experience and knowledge they will be able to apply collaboratively toward helping their clients.

For us as advisors, we strive to bring as many tools and skills as possible to serving our clients. We’re proud that gender balance has been a part of who we are since our inception, both in our leadership and our advisory teams, and we firmly believe that has been powerfully beneficial for our clients. We are excited to see awareness growing and are committed to fostering continued growth of diversity in the investment industry.

Sources:

1https://www.greatbusinessschools.org/women-owned-business-statistics/

2https://www.thebalancecareers.com/women-and-work-1919356

3https://www.catalyst.org/research/women-on-corporate-boards/

4 https://www.mckinsey.com/business-functions/organization/our-insights/delivering-through-diversity

5 https://www.nasdaq.com/articles/how-men-and-women-invest-differently-2016-04-08

6 https://www.entrepreneur.com/article/313972

https://www.careleader.org/differently-men-women-communicate/

https://www.smallbizgenius.net/by-the-numbers/women-in-business-statistics/

https://www.catalyst.org/research/women-in-financial-services/