Client login

Client login

- Blog

- Contact Client login

- privacy-protected,

- intermediated (using private sector accounts, digital wallets, and other services),

- transferable seamlessly between different intermediaries, and

- identity-verified.

650 NE Holladay Street,

The Liberty Centre, Suite 1500

Portland, OR 97232

Central Bank Digital Currency: Perspective on CBDCs

Many governments, including the U.S. Federal Reserve, are exploring the idea of central bank digital currency (CBDC), and some are actively building the infrastructure to put such a system into place. What are CBDCs and how could they affect our financial ecosystem?

What is a Central Bank Digital Currency?

The Bank of International Settlements defines a CBDC as a “digital form of central bank money that is different from balances in traditional reserve or settlement accounts.” This definition is purposely a bit vague, since CBDCs can vary widely in their construction and details. In the U.S., the Federal Reserve defines a CBDC as a “digital liability of a central bank that is widely available to the general public.” The primary difference between a CBDC and the digital dollars you are used to operating with is that your digital dollars are issued by a commercial bank rather than directly by a central bank.

The Federal Reserve is exploring what a CBDC might look like in the U.S., and lays out four primary characteristics it would focus on:

In addition to being a form of digital money that is free from credit and liquidity risk, a U.S. CBDC system could streamline payment processing and improve the efficiency and convenience of using digital money. It could simplify assistance programs like Social Security or disaster relief, enable rapid and easy delivery of wages and payment of taxes, and reduce costs for everyday financial transactions. It could also potentially support the role of the dollar internationally as nations move to digital systems.

What are the concerns about CBDCs?

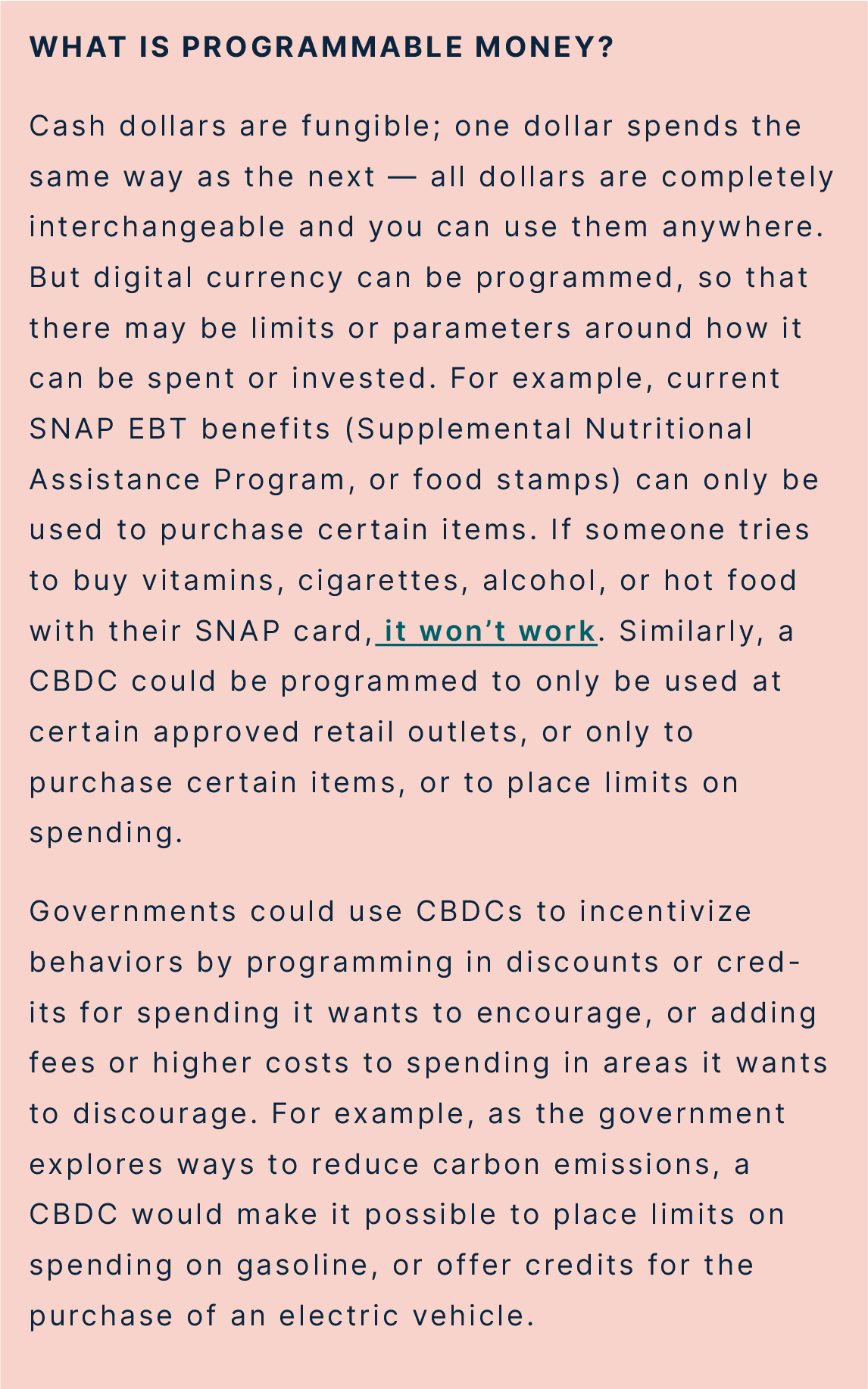

The public has raised a variety of concerns about the potential for a U.S. Federal Reserve CBDC. Privacy and control are a leading issue; CBDC balances and transactions would be visible to the Federal Reserve, with all personal financial activity digitally tracked.

Should a CBDC become the dominant form of money, it raises concerns that the Federal Reserve and its intermediaries would have the power to control an individual’s access to the financial system by limiting it or even cutting it off. The same ease of payment would also make it possible to withdraw taxes or fines automatically, impose negative interest rates or expiration dates on money, or require compliance with mandates in order to access funds. CBDC technology could potentially represent a significant expansion of government power.

Security is another concern. With a CBDC managed through a central system, there is a heightened risk in cases of cyberattacks or identity theft. The Fed acknowledges that “designing appropriate defenses for CBDC could be particularly difficult because a CBDC network could potentially have more entry points than existing payment services.” The Fed also notes that a CBDC could impose stability risks to the financial system by making runs on commercial banks more likely during times of stress, should there be a flight to safety and a widely available CBDC.

Lastly, a CBDC system is inherently digital, and unless accommodations are made to include offline capability, would require all individuals to have access to technology and internet in order to be part of the system. Those who live remotely or operate outside of the grid, those unable to afford technology, and other marginalized populations could be excluded from such a system. Power outages would affect the ability to transact, which could be catastrophic if they last for long periods of time.

What do people think about CBDCs?

Recently, the Federal Reserve solicited public comments related to CBDCs and digital payment systems. With over 5,000 pages of comments responding to a 22-question survey, we didn’t review them all, but examined a random sampling — below, we share a few responses. The responses were roughly 28% in favor/positive and 72% opposed/negative, and it is worth looking at them to get a sense of the public’s response to potential CBDCs.*

(*) Based on a random sample of 200 public responses to the question: Should a CBDC be legal tender?

“I see a tremendous risk to individual freedom. I believe CBDCs will put our ability to buy, sell, and transact at the whims of bureaucrats and politicians. It will eliminate all trace of financial privacy.” Brian Marshall, Idaho. Comments file #2, page 8.

"The primary potential benefit of the Fed moving forward with a CBDC project is the continued use of the U.S. dollar as the world’s primary reserve currency. If we allow other currencies to generate a highly functional CBDC while we procrastinate, the high speed and low overhead of such a currency will incentivize transitioning away from the U.S. dollar.” Matthew Barrett, Maryland. Comments file #4, page 518

“I truly believe that utilizing decentralized stable coins that are already in existence, along with better and clearer guidelines and regulation for stable coins and crypto currencies, we could achieve a more secure and humanitarian digital type currency. The centralized nature of a CBDC can allow for single attack surfaces by hackers, manipulation and corruption from government officials, and more potential ways to interfere with our constitutional rights. The decentralized nature of crypto currency and stable coins allows for more built-in security and less potential manipulation.” Russell Sabia, Texas. Comments file #6 page 61

“One potential benefit of a retail CBDC could be the efficient and direct transfer of government to person payments such as social transfers without the need of an intermediary. This, in-turn, could very well be used for targeted government relief efforts.” Rehan Masood, Pakistan. Comments file #5, page 303.

“Recent Tornado killed our power for days and cash was the only way to buy food and pay bills. Last time we had an ice storm that was so bad we had no power for 1 month. Digital currency will cause the deaths of thousands if not more when there is no power. It is stupid and we will not accept it nor give up cash as legal tender.” Richard, Kentucky. Comments file #5, page 51.

“Digital payments made with a U.S. CBDC can be less expensive, more efficient, and more fraud-resistant than cash, credit, or debit card payments.” Technology Company, New York. Comments file #8, page 745

“Its very existence would adversely affect the financial sector. Digital money controlled by the government is an existential threat to economic autonomy both for individuals and organizations.” Trey Langford, Arkansas. Comments file #6 page 215

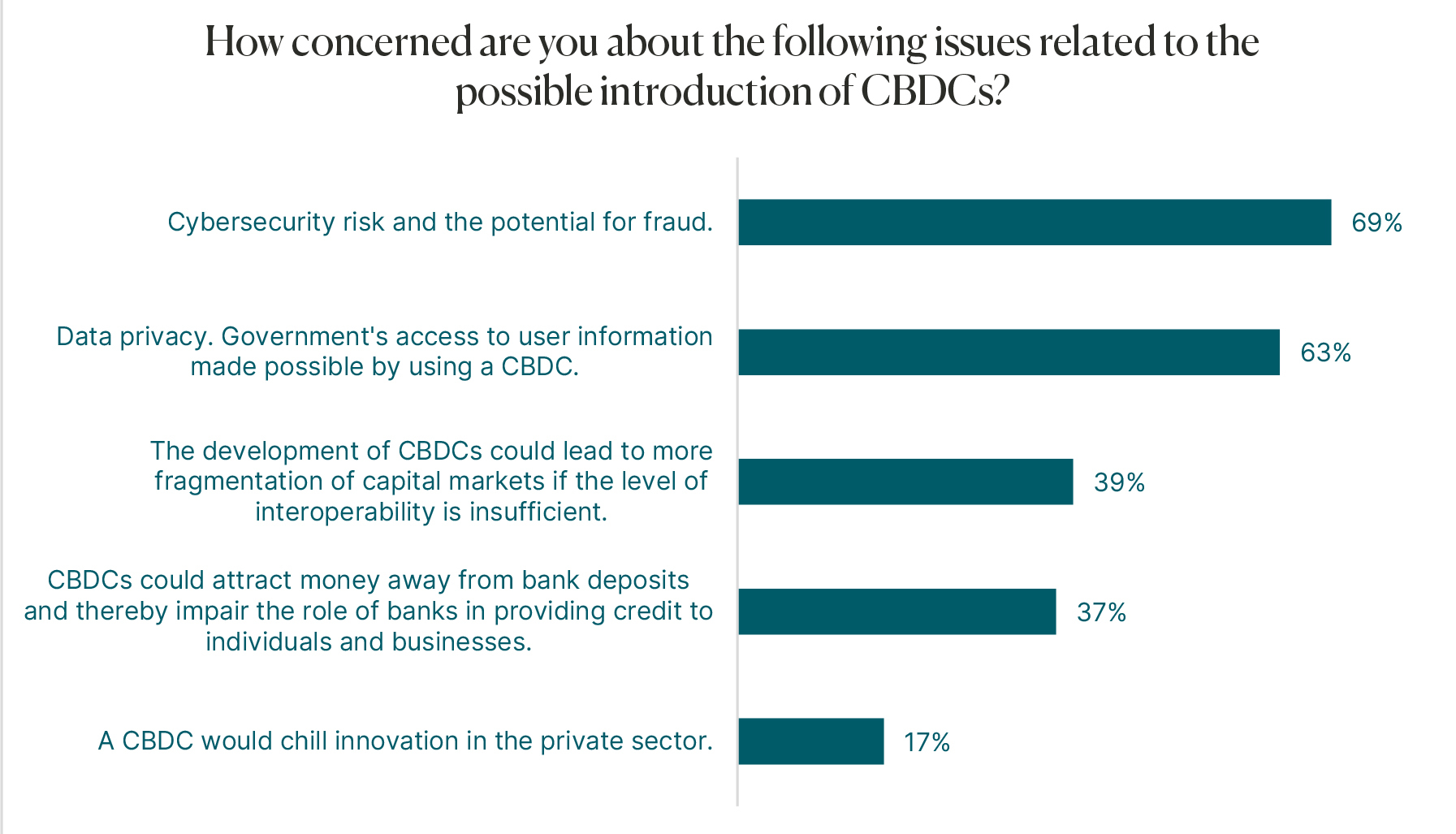

The CFA Institute conducted its own survey on CBDCs (“CFA Institute Global Survey on Central Bank Digital Currencies Report” by Stephen Deane, CFA, and Olivier Fines, CFA, July 2023). The survey was global in scope, including CFA Institute members across Europe, the Middle East, Africa, and the Americas. They found that respondents in emerging markets were much more likely to say they would use a CBDC (67%) compared with developed markets (43%). About half of emerging markets respondents agreed that CBDCs would enhance financial inclusion (55%) and financial stability (50%). These numbers dropped precipitously among developed markets: only 28% of respondents agreed with either statement. Younger people reported knowing less about CBDCs than older respondents but were much more receptive to the idea of using a CBDC. Fewer than 45% across all age groups (and as few as 25% in older age groups) believed that CBDCs are likely to enhance financial inclusion or stability.

Source: “CFA Institute Global Survey on Central Bank Digital Currencies Report” by Stephen Deane, CFA, and Olivier Fines, CFA, July 202

Where do CBDCs stand now?

About 87 countries are exploring CBDC development, and more than 20 have launched pilot programs. China has been using its e-CNY since 2019, and Nigeria was the first African country to roll out a CBDC, with the eNaira in October 2021. You can view a CBDC Tracker here, which tracks the stage of CBDCs in 119 countries that collectively represent more than 95% of global GDP. There are lots of different ways to structure CBDCs and build a CBDC system, so many countries are in the research phase of analyzing the use case and exploring methodologies. The Bank of International Settlements (BIS) Innovation Hub is committed to encouraging and contributing to this research through applied technology, proof of concept, and prototypes with central banks around the world.

You can read the Federal Reserve’s page on CBDC here, which includes a link to a discussion paper exploring the pros and cons of a potential U.S. CBDC. Here are some other helpful resources to learn more about CBDCs:

“What is central bank digital currency (CBDC)” McKinsey; March 2, 2023: https://www.mckinsey.com/featured-insights/mckinsey-explainers/what-is-central-bank-digital-currency-cbdc

“CBDC: Central Bank Digital Currency” by Wayne Duggan, Forbes Advisor; June 6, 2023: https://www.forbes.com/advisor/investing/central-bank-digital-currency-cbdc/

“Money and Payments: The U.S. Dollar in the Age of Digital Transformation” Federal Reserve Board of Governors Research & Analysis; January 2022: https://www.federalreserve.gov/publications/files/money-and-payments-20220120.pdf

“Central Bank Digital Currencies: Policy Issues” Congressional Research Service; updated February 7, 2022: https://crsreports.congress.gov/product/pdf/R/R46850

We’ll continue to follow the CBDC story as it unfolds and share information as things progress.