Client login

Client login

- Blog

- Contact Client login

650 NE Holladay Street,

The Liberty Centre, Suite 1500

Portland, OR 97232

Investment Trends to Watch for in 2023: The Money Revolution

The speed of change is exponential and as we head into 2023, we find ourselves on the steep part of the curve. How are changes in technology, culture, and geopolitics affecting the investment landscape, and what does it mean to be in the midst of a money revolution? Each year, Arnerich Massena’s research team puts their collective heads together to envision what the future might hold, and which trends are likely to take shape. This year, as we face inflation, impossible debt levels, and unprecedented digital opportunities, we anticipate a revolution in what money is and how we use it. Read on to hear about some of the investment trends to watch for in 2023. (Click here to download the full article in pdf format.)

Please note that these predictions are not investment recommendations, but an interesting look at the landscape that could affect the future investment environment for everyone.

The Money Revolution

The politicization of money

What is money? Is it a store of value and a medium of exchange? Or is it a tool for managing an economy, for protecting privacy, for guarding against corruption, or even for encouraging or discouraging behavior? With the rise of digital currencies, we are beginning to see potential new uses for money. Cryptocurrencies like bitcoin and ethereum have been heralded as an opportunity to keep transactions private without resorting to cash, while central banks are exploring their own centralized versions of digital currency (Central Bank Digital Currencies or CBDCs) that can be programmed. What could programmed CBDCs mean for our future?

In 2009, behavioral economists Richard Thaler and Cass Sunstein published Nudge, about how small changes in how choices are presented can make a big difference in moving people toward making different decisions. They applied psychological principles in order to guide people in their economic decision-making. Their research set the stage for using finance as a tool to shape consumer decision-making. We all understand why grocery stores put the most expensive brands at eye level and impulse buys next to the cash register; it nudges you to make purchases you might not otherwise. Imagine using those same mechanisms to shape your financial and behavioral decisions.

In 2019, Mastercard launched its “Doconomy” card, which is intended to use similar mechanisms to guide users’ consumption toward more sustainable choices by calculating the carbon footprint of their buying choices. The theory is that by seeing their carbon usage — or even setting limits on it — users may be more inclined to reduce their carbon consumption.

Enter programmable CBDCs. Imagine that your money had limits to what it could purchase — that, for instance, you had a limit to the number of gallons of gasoline you could purchase each month. Or a maximum limit to candy, or video games. On the flip side, taxes, fees, and penalties could be withdrawn automatically from the digital account tied to your identity. You can see that the possibilities for programming are endless, and all are currently part of the discussion as governments begin building their digital currencies. With implementation getting nearer, we are going to see money become much more political, as politicians start making decisions about how to use money to “nudge” consumers to behave in certain ways.

De-Globalization

The last decade has been one of intense globalization, as the trend toward free trade grew and multi-national corporations proliferated. With years of relative peace and global economic growth, organizations were able to reach across country lines to build out lengthy supply chains and export labor and production costs where they were least expensive.

Starting with the trade war with China, followed by the pandemic, and now with war in Europe and energy shortages, supply chains have fractured and trade agreements are fraying. Companies are recognizing the fragility of sourcing labor and materials in far-away places. When conditions are smooth, long supply chains can reduce costs and simplify production. But as we’ve seen, when things go wrong, a carefully constructed supply chain house of cards can disintegrate rapidly. Supply chain risks have become much more apparent and immediate.

As we head into 2023, we anticipate rapid de-globalization as countries and companies seek to become more self-sufficient and less reliant on factors outside their control for their needs. This will likely be inflationary, as labor is more expensive closer to home, and the cheapest producers may no longer be accessible. This economic nationalism could mean that foreign investments gain added risks with increased isolation, but international investing might also yield new opportunities that offer greater diversification than they would in a more unified global market.

The future of living

If you are a Baby Boomer, Generation X, or Millennial, you may have grown up with the expectation of owning a home in the suburbs and commuting to your job in the city. But future generations are likely to live very differently, and the seeds of that different lifestyle are being planted now.

Saudi Arabia just broke ground on “The Line,” which “redefines the concept of urban development” with a 200-meter wide but 170-kilometer long city that runs on 100% renewable energy, with no roads or cars but which features end-to-end high-speed rail. The Line is intended to accommodate 9 million residents with easy access to all facilities within a five-minute walk for all citizens. Whether the end product lives up to the vision remains to be seen, but Saudi Arabia isn’t the only country looking for more sustainable ways to manage its human population.

Western nations have put forth the idea of “smart cities,” which use the power of technology and surveillance to manage large populations in urban centers with a smaller footprint. Innovations like driverless taxi service and easy drone delivery can cut down on or eliminate the use of personal vehicles, and with remote work, travel and commuting could be greatly reduced. We may be seeing the end of single family home ownership as well, as young families are priced out of real estate, much of which has been acquired by institutional players and turned into rentals. Is this the death of the American Dream, or the birth of a post-industrial utopian civilization?

For investors, the commercial real estate sector is likely to experience increasing weakness, as shared office space is replaced with home offices. But there will probably be more opportunities to participate in the residential rental market, and possibly new options for office sharing and even home sharing.

The end of ownership

SaaS — Software as a Service — refers to the model in which you subscribe to a software solution rather than buying it outright. For an ongoing monthly charge, you benefit from access to upgrades and customer service. This same model is extending into a variety of other areas. It’s become much more common to lease a car, for instance, and even some phone companies are turning to a subscription model, where customers automatically upgrade to new phones periodically.

We are likely to begin seeing this subscription/membership model, which offers stable and predictable revenue for companies, in more and more sectors. As an example, BMW has begun asking car owners to pay a subscription fee to access some features of their vehicles, such as the heated seats and adaptive cruise control, and Tesla owners have to pay monthly for access to full self-driving software in their cars.

Food delivery subscriptions and meal kit memberships have entered the subscription economy. No longer do we purchase DVDs; entertainment is now almost all subscription-based, and education is also moving to a subscription model; think LinkedIn Learning, Masterclass, and Duolingo. Patreon and Substack are avenues for content creators to build a subscription base, and news sites are dividing into “freemium” and “premium” sections.

Memberships and subscriptions offer convenience and improved service for the consumer, and steady revenue with upsell opportunities for businesses. Subscribers have access to the newest models and the best service. As this pricing structure progresses, we are likely to see less ownership of physical goods, and more of a “usership” approach to goods and services. There is a downside, though, as less ownership means less stewardship. Rather than caring for and fixing things, people will simply trade up to the next generation.

Automation and the future of work

This year, Elon Musk unveiled the Tesla “Optimus” humanoid robot prototype, hinting that within a few years, these robots would be available for the price of a used car and could be used for a variety of manual tasks. While that particular robot seems to need some work before it’s ready for mass production, there are already lots of ways in which automation — whether robotic or just computer artificial intelligence — is replacing human labor. That trend will increase exponentially, as intelligent machines and AI bots take over tasks in call centers, retail, scheduling, reporting, and communications. Transportation and manual labor are sectors that are likely next to ramp up automation.

The bad news is that millions of jobs will be destroyed by automation, which is becoming not just more affordable for businesses, but in many cases is an essential cost-cutting measure to remain competitive. On the other hand, we may see new jobs and whole professions develop that depend more on human ingenuity and imagination. Automation could serve to relieve us of dull, repetitive tasks and unleash a new era of creativity.

Demand will almost certainly increase for engineering and robot maintenance, the development of artificial intelligence applications, and software engineering. We may also see the rise of AI psychologists and trainers to help robots develop human personalities and interface more effectively and naturally with humans. And some jobs will be enhanced by automation; for instance, automating processes in healthcare and education will leave more room for providing human care, instruction, and contact.

Identity reality

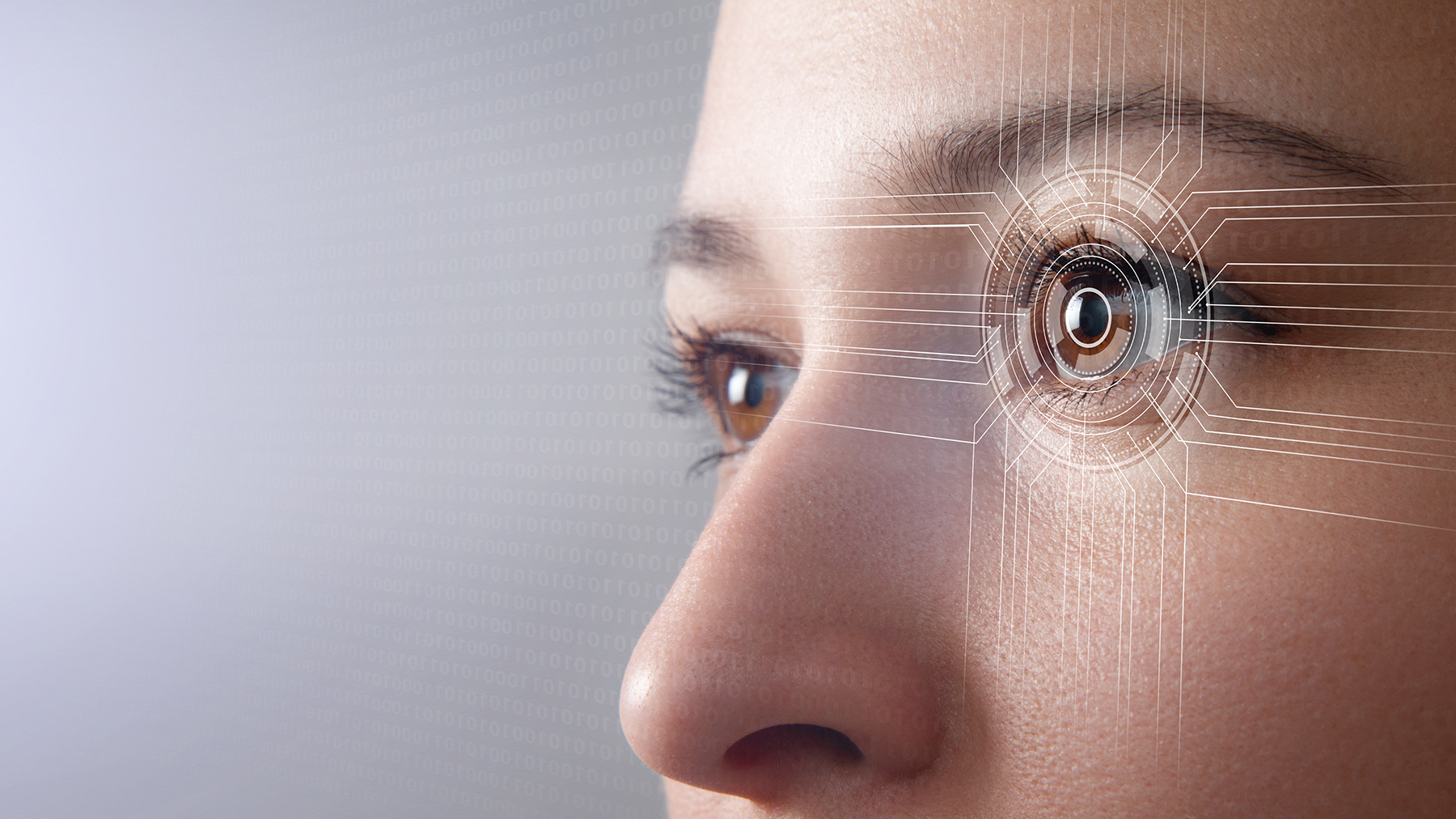

How do you prove that you are you? This is getting ever trickier in an age of identity theft, data breaches, deep fakes, and holograms that are nearly indistinguishable from life. Two-factor authentication has become an essential step in most service login processes, and you probably either have a password keeper or a long list of passwords you use.

The Federal Real ID law goes into effect on May 3, 2023 (extended due to the pandemic). After that date, travelers will need a Real ID-compliant driver’s license — or a passport — to pass through airport security checkpoints or visit certain federal facilities. To acquire a Real ID, you’ll have to provide certain identifying documentation to the DMV. This is the beginning of the age of digital identity.

More and more, we are seeing the use of biometric data to prove and secure one’s identity. You might use your fingerprint or face to unlock your phone, and facial recognition has become a common tool for law enforcement and retail security. Now, airports, banks, healthcare settings, and mobile apps are exploring the use of facial recognition for identification. Voice recognition, palm scans, iris scans, retinal scans, and behavioral biometrics like gait measurements and keystroke dynamics — these are all techniques being developed and improved for accurate authentication. The advantages of biometric identification are that it theoretically cannot be forged, stolen, or forgotten, making it highly secure and highly accurate. However, there is some risk of error and no technique is 100% reliable all the time.

Biometrics are not without other risks also. There are privacy concerns about using biometric data, particularly because once that data has been collected by a third party, it is outside of the user’s control. How that data is managed, stored, and used is of utmost concern.

With physical and digital identities merging, this also may spell the end of online anonymity. Between an effort to rid themselves of bots and collect data on users, more and more web retailers and service providers are demanding proof that a real person is behind the password. In 2023, we may see battles over privacy, data use, and identification verification.

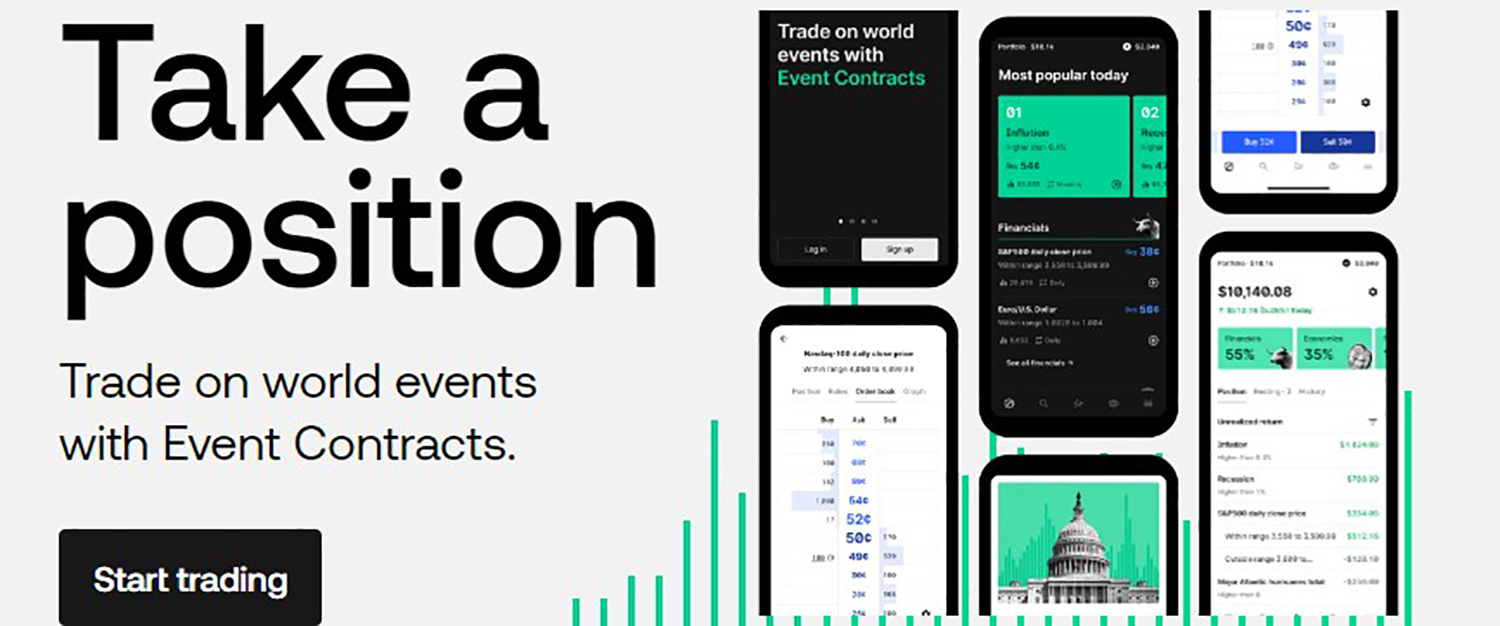

Prediction Markets

Investopedia describes prediction markets as markets “where people can trade contracts that pay based on the outcomes of unknown future events.” Otherwise known as information markets, these unusual investment (or betting, depending on how you view them) vehicles are becoming ever more popular. Similar to futures markets, they involve multiple individuals speculating on the future results of a variety of events such as election results, quarterly sales, digital currency predictions, and movie grosses.

PredictIt, the Iowa Electronics Market, Kalshi, and Polymarket are some of the most well-known of the prediction markets. The U.S. Commodity Futures Trading Commission (CFTC) has reacted ambiguously to these markets; while ex-CFTC Commissioner Brian Quintenz is on the board of Kalshi, which expects regulatory approval for its election market, PredictIt has been ordered to shut down U.S. operations and is filing to appeal that decision.

We anticipate continued growth of these markets; though they face hurdles on their path to legitimacy, it’s likely they will continue to grow in popularity.

Spend it now versus save for tomorrow

Inflation has been the story of 2022, and we don’t expect it to go away completely in 2023, though hopefully the Federal Reserve can tamp it down to some degree. With inflation comes an increase in return expectations for cash, CD, and fixed income investments, making saving in these vehicles more attractive. Many investors will take advantage of the increased return on saving to put their dollars away for a rainy day.

On the other hand, inflation can spur spending as people start using their dollars now, concerned that those dollars will purchase less in the future. When prices go up, money loses value while real assets appreciate in price. We may see more investors looking to buy real tangible assets — including precious metals like gold and silver or real assets such as land or commodities — in an attempt to guard against continued future inflation.

Next year may be a year of seesawing between saving and spending, as the Fed works to bring inflation under control and find a balance of supply and demand.

Customized portfolios

Mutual funds were designed to help investors invest in a broad swathe of companies in a single vehicle, allowing one to build diversification into a portfolio at a reasonable cost. The expense of trading historically made it prohibitive for most investors to build a portfolio by investing in individual company stocks and then managing ongoing individual stock trades. Over time, funds have become ever more specialized, offering investors different slices of the equity pie. But investors had to find funds that matched their goals, and relied on the fund manager — or index algorithm — to select and manage the underlying investments.

Now, custom indexing is on the rise, offering investors the opportunity to be more selective about which companies and/or sectors they want to include in their portfolio, tweaking the index to meet their specifications. Custom indexing uses separately managed accounts to allow investors to invest in each individual stock rather than a pool of investments such as you would find in a fund. Without the trading cost of commissions, this has now become a cost-effective strategy for individual investors.

By using this strategy, investors can engage in daily tax-loss harvesting, optimizing the tax efficiency of a portfolio. Furthermore, custom indexing is also useful for investors who want to align their investments with their personal values. It allows investors to identify themes and sectors they want to either avoid or lean into, depending on where they want to focus their investment dollars. Whereas ESG investing has relied on third-party ratings and reporting, personalized indexing allows investors to make their own choices about what will be most impactful for them.

Energy as the new anti-fragile asset

In 2022, it seemed like there was no safe haven for investors. With both stocks and bonds struggling, and inflation eating into cash, investors were at a loss. But there was one sector that has strengthened despite the challenging market environment, and that we expect will continue its strong showing in 2023: energy.

The world needs energy to run civilization; it is fundamental to our thesis of “investing in what the world needs.” The need for energy applies whether that energy comes from natural gas, nuclear, solar, water, wind, oil, or coal. Energy is essential, and we think of it as the new anti-fragile asset.

We all would like as much of that energy as possible to be clean and renewable, which is why we invest in natural gas, wind, and solar energy, as well as technologies that can make our existing grid function more sustainably. But the reality is that it will take some time to build out the necessary infrastructure to allow us to move away from fossil fuels. Highlighting the disparity between the ideal and the real, California has mandated that all vehicles in the state must run on electricity or hydrogen by 2035, but shortly after making that announcement this last September, officials were asking electric car owners not to charge their cars during peak hours so as not to strain the state’s fragile electrical grid.

We need investment across a variety of energy sources and solutions, and fortunately, it looks as if investors will be rewarded for that investment.

Conclusion

As we head into a recessionary environment next year, there will be winners and losers. Companies that are carrying clean balance sheets and that have pricing power have an advantage, whereas firms with significant debt will face rising interest rates. Many companies may see a shrinking customer base, as belts tighten and as the early waves of job loss due to automation begin. Companies will also have to focus on shoring up supply lines and finding ways to adapt to a shifting global environment.

The money revolution will impact everyone as we continue to redefine the ways in which we transact, save, and spend. And that will be closely tightly tied to our digital identity and data. At the same time, our lives are experiencing major upheavals with new ways of working and lifestyle arrangements.

As investors, our job is to look toward the future to understand where capital will have the most potential for growth and impact. This year, we’ll be focusing on ways to counter the effects of inflation, on opportunities to take advantage of new investment structures like custom indexing, and on innovations in energy and financial services. We look forward to seeing you in 2023!